sopsimcan.site

News

Maine Lobster Spread

Prep time: 10 minutes Ready in: 10 minutes Ingredients: 7 Ounces of Cape Porpoise Maine Lobster Meat 1 Tablespoon Lemon Juice 4 Tablespoons butter. The live Maine lobster (also known as the American, Atlantic, or Canadian lobster) – one of the pinnacles of fresh seafood cuisine – shipped fresh. Need a dip that's easy to make but still packs a punch? We've got you covered. This cream cheese based dip is perfect for a nice summer treat! Inland Market Maine Lobster Spread - Photo. There are calories in serving of Premium Maine Lobster Spread from: Carbs 3g, Fat 15g, Protein 6g. Get full nutrition facts. See if Inland Market Premium Foods Maine Lobster Spread is Low FODMAP, Gluten Free, Vegan, Vegetarian, Dairy Free & more. Our Premium Maine Lobster Spread is made with an abundance of freshly harvested cold water lobster. Get ready for the weekend with this. It was a nice, fresh spread as an appetizer. It was very tasty on crackers and bread. Will be buying it again. Even though lobster is the first ingredient, there is absolutely no lobster flavor to it. (You can tell there's something in there because of. Prep time: 10 minutes Ready in: 10 minutes Ingredients: 7 Ounces of Cape Porpoise Maine Lobster Meat 1 Tablespoon Lemon Juice 4 Tablespoons butter. The live Maine lobster (also known as the American, Atlantic, or Canadian lobster) – one of the pinnacles of fresh seafood cuisine – shipped fresh. Need a dip that's easy to make but still packs a punch? We've got you covered. This cream cheese based dip is perfect for a nice summer treat! Inland Market Maine Lobster Spread - Photo. There are calories in serving of Premium Maine Lobster Spread from: Carbs 3g, Fat 15g, Protein 6g. Get full nutrition facts. See if Inland Market Premium Foods Maine Lobster Spread is Low FODMAP, Gluten Free, Vegan, Vegetarian, Dairy Free & more. Our Premium Maine Lobster Spread is made with an abundance of freshly harvested cold water lobster. Get ready for the weekend with this. It was a nice, fresh spread as an appetizer. It was very tasty on crackers and bread. Will be buying it again. Even though lobster is the first ingredient, there is absolutely no lobster flavor to it. (You can tell there's something in there because of.

Our Gourmet Maine Lobster Spread is made with an abundance of fresh cold water lobster. We blend in premium mayonnaise, fluffy panko breadcrumbs. Inland Maine Lobster Spread found at Hannaford Supermarket. Add to online shopping list or grocery cart for Hannaford To Go. Maine lobster spread by contains calories per 55 g serving. This serving contains 8 g of fat, 6 g of protein and 9 g of carbohydrate. The latter is 0 g. There are calories in 4 oz Maine lobster spread, made by Inland Market. They contain 12g of protein, 19g of carbohydrates, and 17g of fat. Premium Maine Lobster Spread is made with an abundance of freshly harvested, cold water lobster with premium mayonnaise, fluffy panko breadcrumbs. 2 oz of maine lobster spread (Inland Market) contains Calories. The macronutrient breakdown is 27% carbs, 55% fat, and 18% protein. This has a moderate. Ingredients · 2 (1½ pound) live Maine lobsters · 16 ounces cream cheese, softened · 2 shallots, minced · 1 clove garlic, minced · 1 tablespoon horseradish · 1. 2 oz of maine lobster spread (Inland Market) contains Calories. The macronutrient breakdown is 7% carbs, 83% fat, and 9% protein. This has a relatively high. There are calories in 2 oz of Maine Lobster Spread from: Carbs 3g, Fat g, Protein 6g. Get full nutrition facts. Buy Inland Seafood Maine Lobster Spread online with quick same day delivery to your door. Shop with Shipt. Ingredients · 1 cup Maine Lobster meat, chopped · 8 ounces cream cheese, softened · ¼ teaspoon garlic powder · ½ cup mayonnaise · 1 teaspoon powdered mustard. With Inland Market Maine Lobster Spread, you can now enjoy the decadence of Maine Lobster any time. Made with cold water lobster freshly harvested off the coast. This Maine lobster dish came to party. In less than 15 minutes, you'll have a fun and decadent dish that's the ideal appetizer that you won't want to share. Made Only In Small Batches, This Dip Is The Ultimate Holiday Snack Food! It's Smooth & Creamy And Loaded With Chunks Of Lobster! This is a staple appetizer. ingredients · 2 (8 ounce) packages cream cheese · 2 cups cooked maine lobster meat · 2 tablespoons freshly minced onions · ⁄2 tablespoon fresh horseradish · 1. Discover Inland Market Maine Lobster Spread, 7 oz at Rouses Markets in Spanish Fort. Reserve your Curbside Pickup time slot now! Personalized health review for Inland Market Premium Maine Lobster Spread: calories, nutrition grade (D plus), problematic ingredients, and more. Order online Maine Lobster Spread on sopsimcan.site Maine Lobster Dip Using a food processor, lightly chop the blanched almonds. Using same processor, lightly chop onion. Place onion in a large bowl and add.

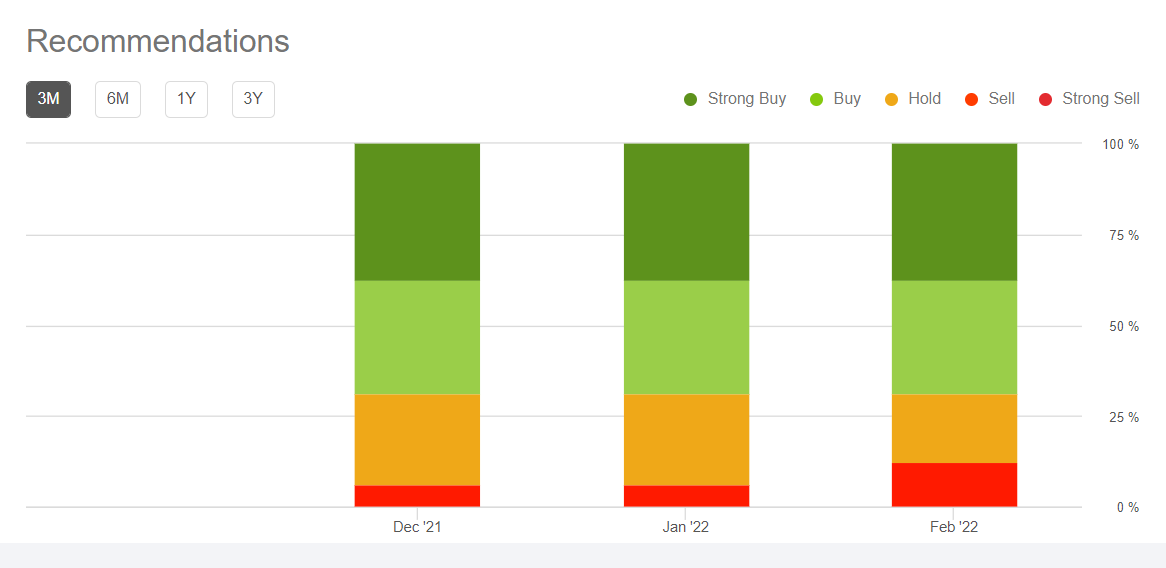

Patterson Uti Stock

Discover real-time Patterson-UTI Energy, Inc. Common Stock (PTEN) stock prices, quotes, historical data, news, and Insights for informed trading and. If the lower trend floor at $ is broken, it will firstly indicate a stronger fall rate. Given the current short-term trend, the stock is expected to fall -. Key Data. Open $; Day Range - ; 52 Week Range - ; Market Cap $B; Shares Outstanding M; Public Float M; Beta Patterson-UTI Energy is one of the largest land rig drilling contractors in the United States. Its merger with NexTier greatly expanded its pressure. You can buy Patterson-UTI Energy Inc (PTEN) stock and many other stocks or ETFs on Stash. Purchase fractional shares with any dollar amount. On average, Wall Street analysts predict that Patterson Uti Energy's share price could reach $ by Sep 4, The average Patterson Uti Energy stock price. Patterson-UTI Energy Inc. ; Open. $ Previous Close$ ; YTD Change. %. 12 Month Change. % ; Day Range - 52 Wk Range - PTEN - Patterson-UTI Energy, Inc. Stock - Stock Price, Institutional Ownership, Shareholders (NasdaqGS). Patterson-UTI Energy Inc. · AT CLOSE PM EDT 08/02/24 · USD · % · Volume7,, Discover real-time Patterson-UTI Energy, Inc. Common Stock (PTEN) stock prices, quotes, historical data, news, and Insights for informed trading and. If the lower trend floor at $ is broken, it will firstly indicate a stronger fall rate. Given the current short-term trend, the stock is expected to fall -. Key Data. Open $; Day Range - ; 52 Week Range - ; Market Cap $B; Shares Outstanding M; Public Float M; Beta Patterson-UTI Energy is one of the largest land rig drilling contractors in the United States. Its merger with NexTier greatly expanded its pressure. You can buy Patterson-UTI Energy Inc (PTEN) stock and many other stocks or ETFs on Stash. Purchase fractional shares with any dollar amount. On average, Wall Street analysts predict that Patterson Uti Energy's share price could reach $ by Sep 4, The average Patterson Uti Energy stock price. Patterson-UTI Energy Inc. ; Open. $ Previous Close$ ; YTD Change. %. 12 Month Change. % ; Day Range - 52 Wk Range - PTEN - Patterson-UTI Energy, Inc. Stock - Stock Price, Institutional Ownership, Shareholders (NasdaqGS). Patterson-UTI Energy Inc. · AT CLOSE PM EDT 08/02/24 · USD · % · Volume7,,

Patterson-UTI is equipped for the future of power with a suite of integrated energy solutions. We are a leading provider of natural gas fueling and handling for. Stock analysis for Patterson-UTI Energy Inc (PTEN:NASDAQ GS) including stock price, stock chart, company news, key statistics, fundamentals and company. Patterson-Uti Energy (PTEN) has a Smart Score of 7 based on an analysis of 8 unique data sets, including Analyst Recommendations, Crowd Wisdom. Patterson-UTI Energy Inc. ; Shares Outstanding, M ; EPS (TTM), $ ; P/E Ratio (TTM), ; Dividend Yield, % ; Latest Dividend, $ Patterson-UTI Energy Inc PTEN:NASDAQ · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date09/14/23 · 52 Week Low Patterson-UTI Energy Inc ; May, Upgrade, JP Morgan, Underweight → Neutral, $20 ; Apr, Initiated, The Benchmark Company, Buy, $ Drilling Rig Leader Poised for Breakout. · Nvidia Stock, Tesla, XP Among 10 New Entries In IBD's Top Stock Screens · Stocks Showing Improving Market Leadership. View Patterson-UTI Energy, Inc. PTEN stock quote prices, financial information, real-time forecasts, and company news from CNN. About Patterson-UTI Energy (PTEN) ; Today's range. $ - $ ; Debt / equity. x ; 52 week range. $ - $ ; 5 year debt / equity. x ; Beta (LTM). Patterson-UTI Energy, Inc. (NASDAQ:PTEN) today reported that for the month of May , the Company had an average of drilling rigs operating in the United. The average price target is $ with a high forecast of $ and a low forecast of $ The average price target represents a % change from the. See the latest Patterson-UTI Energy Inc stock price (PTEN:XNAS), related news, valuation, dividends and more to help you make your investing decisions. The current price of PTEN is USD — it has decreased by −% in the past 24 hours. Watch Patterson-UTI Energy, Inc. stock price performance more closely. Research Patterson-UTI Energy's (Nasdaq:PTEN) stock price, latest news & stock analysis. Find everything from its Valuation, Future Growth, Past Performance. Get the latest updates on Patterson-UTI Energy, Inc. Common Stock (PTEN) after hours trades, after hours share volumes, and more. Borr Drilling Ltd. $ BORR % ; Baker Hughes Co. $ BKR % ; Diamond Offshore Drilling Inc. $ DO % ; In the news. Benzinga. 1 day ago. Patterson UTI Energy stock quote and PTEN charts. Latest stock price today and the US' most active stock market forums. The stock price for Patterson-UTI Energy (NASDAQ: PTEN) is $ last updated September 6, at PM EDT. Q. Does Patterson-UTI Energy (PTEN) pay a. FAQ ; What Is the Patterson-UTI Energy (PTEN) Stock Price Today? The Patterson-UTI Energy stock price today is ; What Stock Exchange Does Patterson-UTI. Patterson Uti Energy reported $M in Stock for its fiscal quarter ending in June of Data for Patterson Uti Energy | PTEN - Stock including.

Credit Cards Offering Zero Percent Balance Transfer

Reflect® Card 0% intro APR for 21 months from account opening on purchases and qualifying balance transfers. %, % or % variable APR thereafter. If researched thoroughly, zero percent or low-interest credit card balance transfer can be a good way to combine multiple, higher-interest credit card balances. Citi Double Cash® Card: Best feature: month 0% introductory rate on balance transfers. Citi Simplicity® Card: Best feature: 0% introductory APR promotion. Low Introductory APR Offer Introductory 0% † APR for your first 18 billing cycles for purchases, and for any balance transfers made within 60 days of opening. “Credit card companies offer 0% balance transfer offers as a way to entice you to apply for their credit card,” says certified financial planner Colin Drake of. Citi Double Cash® Card: 0% intro period for the first 18 months on balance transfers (after, % - % variable APR; see rates and fees). Balance. Compare balance transfer credit cards with a low introductory APR at sopsimcan.site Discover balance transfer credit card offers today! The best debt consolidation credit card is the Citi Simplicity® Card because it offers an intro APR of 0% for 21 months on balance transfers, along with a $0. Pay down credit card debt with a balance transfer card and get up to 15+ months in 0% intro APR. Compare balance transfer credit card offers. Reflect® Card 0% intro APR for 21 months from account opening on purchases and qualifying balance transfers. %, % or % variable APR thereafter. If researched thoroughly, zero percent or low-interest credit card balance transfer can be a good way to combine multiple, higher-interest credit card balances. Citi Double Cash® Card: Best feature: month 0% introductory rate on balance transfers. Citi Simplicity® Card: Best feature: 0% introductory APR promotion. Low Introductory APR Offer Introductory 0% † APR for your first 18 billing cycles for purchases, and for any balance transfers made within 60 days of opening. “Credit card companies offer 0% balance transfer offers as a way to entice you to apply for their credit card,” says certified financial planner Colin Drake of. Citi Double Cash® Card: 0% intro period for the first 18 months on balance transfers (after, % - % variable APR; see rates and fees). Balance. Compare balance transfer credit cards with a low introductory APR at sopsimcan.site Discover balance transfer credit card offers today! The best debt consolidation credit card is the Citi Simplicity® Card because it offers an intro APR of 0% for 21 months on balance transfers, along with a $0. Pay down credit card debt with a balance transfer card and get up to 15+ months in 0% intro APR. Compare balance transfer credit card offers.

The Wells Fargo Reflect lets you skip interest on purchases and balance transfers for 21 months. 5 min read Jul 09, Shot of a young. Which Capital One balance transfer credit card is best for you? ; 0% intro APR for 15 months; % - % variable APR after that; Balance transfer fee. Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. · Balance Transfers do not earn cash back. · If you transfer a balance, interest. After the intro APR offer ends, your rate will range from % to %.1; No annual fee.2; No balance transfer fees. No cash advance fees. No foreign. Bank of America® Travel Rewards credit card. 0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first. No fee and 0%? None that I've ever seen and I have almost every credit card. Almost all cards will be 0% balance transfers but the fee can range. 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that. A balance transfer credit card can be a powerful tool in your debt-busting arsenal. A 0% introductory APR offer on a credit card can save money. Wells Fargo Reflect 0% APR on balance transfers (within days) AND purchases for 21 months. Balance transfer fee is high (mine is 5%) and. Best Balance Transfer Credit Cards · Citi Double Cash Card · Citi Rewards+ Card · Discover it® Chrome · Citi Custom Cash Card · Wells Fargo Active Cash Card · Wells. 0% intro APR for 15 months from account opening on purchases and balance transfers. After the intro period, a variable APR of Min. of (+) and. A 0% introductory APR offer on a credit card can save money by having all your payments go toward knocking out the principal balance instead of being used to. 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that. Our best balance transfer offer. Get a 0% introductory APR on balance transfers for the first 18 billing cycles after account opening. After that, %, 0% intro APR for 21 months from account opening on purchases and qualifying balance transfers. %, % or % variable APR thereafter. Balance. 10 partner offers ; Wells Fargo Active Cash Card · 0% intro APR for 12 months from account opening on purchases and qualifying balance transfers · %, %. You could be charged a fee for making the switch – typically between 1% and 4% of the amount you're moving across. An interest-free balance transfer card works. You can get a % intro APR for 12 months from account opening on balances transferred within 60 days. You'll also pay no balance transfer fees. 0% intro APR for 18 months from account opening on purchases and balance transfers. After the intro period, a variable APR of Min. of (+) and. Explore low intro rate credit cards ; 0% intro APR for 15 months; % - % variable APR after that; Balance transfer fee applies. See pricing and terms.

How To Make Your Phone Bill Cheaper

Discover Ways To Lower Your Household Bills · Save on Your Internet Bill · Save on Your Cell Phone Bill · Save on Gas and Electricity · Save on Water Bills · Find. You could consider turning off your device's ability to switch to mobile data when out of Wi-Fi range. A Spend Cap can help you limit usage outside of your. Use Wi-Fi when you can. · Limit your background data use. · Cut the insurance. · Sign up for automated payments or paperless billing. Get all the details on your paper or digital bill below. Log in to My Account to view your digital bill. Or view a paper bill version. 1. Consider switching to an alternative low-cost carrier · 2. Bundle with friends and family · 3. Use the right credit card · 4. Analyze your current plan. If you're employed, check if your employer has a benefit package - you might be able to get cheap internet, mobile and TV deals. If you're getting benefits. You. How to Lower Your Cell Phone Bill: 9 Simple Tips That Can Result in Big Savings · 1. Family or group plan · 2. Audit your bill · 3. Monitor your data usage · 4. 4. Haggle for a better deal You should start haggling a month before your contract ends, as your provider will be in a position to offer you a better deal. The best way to cut your cell phone device cost is by purchasing a cell phone that is a couple of generations out of date. For instance, consider buying the. Discover Ways To Lower Your Household Bills · Save on Your Internet Bill · Save on Your Cell Phone Bill · Save on Gas and Electricity · Save on Water Bills · Find. You could consider turning off your device's ability to switch to mobile data when out of Wi-Fi range. A Spend Cap can help you limit usage outside of your. Use Wi-Fi when you can. · Limit your background data use. · Cut the insurance. · Sign up for automated payments or paperless billing. Get all the details on your paper or digital bill below. Log in to My Account to view your digital bill. Or view a paper bill version. 1. Consider switching to an alternative low-cost carrier · 2. Bundle with friends and family · 3. Use the right credit card · 4. Analyze your current plan. If you're employed, check if your employer has a benefit package - you might be able to get cheap internet, mobile and TV deals. If you're getting benefits. You. How to Lower Your Cell Phone Bill: 9 Simple Tips That Can Result in Big Savings · 1. Family or group plan · 2. Audit your bill · 3. Monitor your data usage · 4. 4. Haggle for a better deal You should start haggling a month before your contract ends, as your provider will be in a position to offer you a better deal. The best way to cut your cell phone device cost is by purchasing a cell phone that is a couple of generations out of date. For instance, consider buying the.

Mobile virtual network operators (MVNOs) charge cheaper prices because they lease wireless capacity from bigger companies, rather than maintaining their own. 9 Ways To Reduce Your Phone Bill and Incur Huge Savings For Business · 1. Auto-Renew Contracts: · 2. 3rd Party Billing Charges: · 3. Wire Maintenance Plans: · 4. Bring your phone to Metro and get our best price for single line phone plans - just $25 for UNLIMITED 5G data on the blazing fast T-Mobile network! 1. Take Advantage Of Employee Discounts: · 2. Cut The Insurance: · 3. Cut Out The Stuff You Don't Use: · 4. Buy No Contract Phones: · 5. Avoid. 1. Check Your Bill for Hidden Charges · 2. Downgrade Your Cell Phone Plan · 3. Use WiFi and Less Data · 4. Eliminate Cell Phone Insurance · 5. Save Money by Putting. switch to a lower cost plan with less bundled items · stay within the bundled use or minimise how far you go over it. · Don't do non-bundled. Boost Mobile built America's newest 5G network, with 99% nationwide coverage. Move to a joint account One last tip for cellphone contract holders, combine accounts to save money. Instead of having individual plans for everyone in your. Scale back your services If your bill keeps rising every month, it's time to look at what you are paying for. Perhaps you can scale back the data plan on your. If you want to stick to a major carrier, make sure that you ask for all the possible discounts available. Many carriers will pay off your phone and cover the. Employee and School Discounts · Analyze Your Bill and Find a New Plan · Consider Prepaid · Find a New Family · Ask for a Better Deal. Buying the handset outright through a reseller website and getting a SIM-only deal can sometimes work out cheaper than buying your phone as part of a contract. Move to a joint account One last tip for cellphone contract holders, combine accounts to save money. Instead of having individual plans for everyone in your. In some cases, you can purchase a limited amount of high-speed data each month for a lower price, but the discount may not be significant. For instance, AT&T. Cheaper mobile phones You get minutes, texts and mobile data but do not pay for a device. Buy credit in advance and only pay for what you use. You need to. How to Lower Your Cell Phone Bill: 9 Simple Tips That Can Result in Big Savings · 1. Family or group plan · 2. Audit your bill · 3. Monitor your data usage · 4. Cheaper mobile phones You get minutes, texts and mobile data but do not pay for a device. Buy credit in advance and only pay for what you use. You need to. How do I pay my AT&T bill by phone? What payment Did you know you might be able to lower your monthly AT&T bill by using AutoPay to make your payments? 1. Learn How to Assess "Total Cost of Ownership" of a Phone System Solution · Plain Old Telephone Service - Here, your costs are pretty straightforward. · POTS. Manage your plan from your phone. Use the app to check your bill, find phone deals, and get real-time support. Illustration of lines in the shape of a family.

Low Maintenance Bank Account

The minimum credit limit amount is $50 and the maximum is $1, Your Limit may change if your direct deposit activity changes. A 5% cash advance fee will be. In a nutshell, it means you don't need to keep a minimum amount in your account. No more stress about hitting a particular balance — just a straightforward. You don't have to pay for checking. See the best free checking accounts at traditional banks, neobanks and credit unions. A single-deposit savings account with a fixed rate for the term of the account. $ Minimum Balance. No monthly service charges. Open. Simple banking with an easy-to-use experience. Open now - Advantage SafeBalance Banking. $ or $0 Monthly maintenance fee. Benefits You Can Bank On · No hidden fees, no minimum balance · A contactless debit card · Fraud protection. Special offer: No monthly maintenance fee if you're ages · Monthly fee: $ No minimum daily balance requirement · Account perks: No overdraft fees or. The TD Bank Simple Savings account has no monthly maintenance fee for 12 months, or ever with just a $ minimum daily balance. Learn more and open an. There is no monthly maintenance fee on our Advantage Savings account if you're under age Learn more about banking for students and young adults. The minimum credit limit amount is $50 and the maximum is $1, Your Limit may change if your direct deposit activity changes. A 5% cash advance fee will be. In a nutshell, it means you don't need to keep a minimum amount in your account. No more stress about hitting a particular balance — just a straightforward. You don't have to pay for checking. See the best free checking accounts at traditional banks, neobanks and credit unions. A single-deposit savings account with a fixed rate for the term of the account. $ Minimum Balance. No monthly service charges. Open. Simple banking with an easy-to-use experience. Open now - Advantage SafeBalance Banking. $ or $0 Monthly maintenance fee. Benefits You Can Bank On · No hidden fees, no minimum balance · A contactless debit card · Fraud protection. Special offer: No monthly maintenance fee if you're ages · Monthly fee: $ No minimum daily balance requirement · Account perks: No overdraft fees or. The TD Bank Simple Savings account has no monthly maintenance fee for 12 months, or ever with just a $ minimum daily balance. Learn more and open an. There is no monthly maintenance fee on our Advantage Savings account if you're under age Learn more about banking for students and young adults.

Truist One Money Market Account · $12 or · $0 monthly maintenance fee if you maintain a minimum daily ledger balance of $1, or more. No fee for the first 6. Enjoy peace of mind with overdraft protection and no minimum balance. No minimum balance requirement; Zero monthly maintenance fees when you enroll in e-. However, certain types of Savings Accounts don't mandate a minimum balance, they are called zero-balance Savings Account. The idea is simple - you can open a. Find information on rates and fees for your Bank of America accounts. Learn about monthly maintenance fees, ways to help avoid overdraft fees, and more. minimum balance required for top APY. Ally Bank offers a checking account that doesn't have a monthly maintenance fee or a minimum opening deposit. It also. Learn more about Bank of America account fees, including monthly maintenance fees for checking and savings accounts. Review additional fees here. Discover worry-free spending and no overdraft fees with this free, low-maintenance account. View Direct Access Checking. Compare. Compare checking accounts. MINIMUM OPENING DEPOSIT IS $ MINIMUM BALANCE TO EARN INTEREST IS $ *ANNUAL PERCENTAGE YIELD (APY) ACCURATE AS OF EFFECTIVE DATE STATED ABOVE. RATES. It's an account meant to hold money that you don't need every day and for which you don't have to pay a monthly maintenance fee. It could also fall into various. Top 10 Checking Accounts for Seniors · 1. Chase Bank · 2. US Bank · 3. BB&T Bank · 4. Northpointe Bank · 5. Consumers Credit Union · 6. One American Bank · 7. Lake. Truist One Checking - a personal checking account with no overdraft fees + 5 ways to waive the monthly maintenance fee. Open your new checking account online. Truist One Checking - a personal checking account with no overdraft fees + 5 ways to waive the monthly maintenance fee Account must be opened for a minimum of. With a First Citizens free checking account, you can manage your money anywhere—without a monthly maintenance fee. Open a fee-free online bank account. Diversify your retirement portfolio; Enjoy competitive, tiered interest rates; Access tax advantages; Waive monthly maintenance fees. MINIMUM OPENING DEPOSIT. Choose an account ; EZChoice. Our most popular option with the essentials you need. · No monthly maintenance fee · No minimum balance requirement ; MyWay Banking. No surprise fees. Pay a $ monthly maintenance fee with no minimum balance penalty. Fee cannot be waived. Banking essentials. Directly deposit paychecks. SafeBalance Banking is a smart choice for students and young adults with no monthly maintenance fee for SafeBalance Banking accounts with an owner under $0 maintenance service charge requirements: Maintain a minimum daily balance of $ or per statement cycle, receive a direct deposit or swipe your debit card. $ if balance falls below $10, any day in the statement period. Monthly Maintenance Fee is based on minimum daily balance. Additional Account Features. With a MyFree Checking account, you get a free, online checking account with no minimum balance requirements, maintenance fees or hidden restrictions.

How Much Savings Should I Have

However, a good rule of thumb for a year-old is to have $6, in a savings account for emergencies and long-term financial goals. And that requires you to. The rule of thumb when it comes to how much of your income you should save is 20%. Why 20%? The premise is that you divide your spending and savings into. Here's a final rule of thumb you can consider: at least 20% of your income should go towards savings. More is fine; less may mean saving longer. At least 20% of. The general rule of thumb is that you should save 20% of your salary for retirement, emergencies, and long-term goals. By age 21, assuming you have worked full. How Much Should I Save for Retirement Each Year? One rule of thumb is to save 15% of your annual earnings. In a perfect world, savings would begin in your 20s. how much you should have saved during each decade of your career. How much should I save for retirement? The bottom-line goal of retirement planning is. Fidelity's guideline: Aim to save at least 1x your salary by 30, 3x by 40, 6x by 50, 8x by 60, and 10x by · Factors that will impact your personal savings. When considering average savings by age 30, data shows you should have at least $14, to $28, in savings and $61, in retirement savings If your. Most financial experts suggest you need a cash stash equal to six months of expenses: If you need $5, to survive every month, save $30, Personal finance. However, a good rule of thumb for a year-old is to have $6, in a savings account for emergencies and long-term financial goals. And that requires you to. The rule of thumb when it comes to how much of your income you should save is 20%. Why 20%? The premise is that you divide your spending and savings into. Here's a final rule of thumb you can consider: at least 20% of your income should go towards savings. More is fine; less may mean saving longer. At least 20% of. The general rule of thumb is that you should save 20% of your salary for retirement, emergencies, and long-term goals. By age 21, assuming you have worked full. How Much Should I Save for Retirement Each Year? One rule of thumb is to save 15% of your annual earnings. In a perfect world, savings would begin in your 20s. how much you should have saved during each decade of your career. How much should I save for retirement? The bottom-line goal of retirement planning is. Fidelity's guideline: Aim to save at least 1x your salary by 30, 3x by 40, 6x by 50, 8x by 60, and 10x by · Factors that will impact your personal savings. When considering average savings by age 30, data shows you should have at least $14, to $28, in savings and $61, in retirement savings If your. Most financial experts suggest you need a cash stash equal to six months of expenses: If you need $5, to survive every month, save $30, Personal finance.

Set Aside 10 Percent of Your Income: When it comes to growing your savings, most experts suggest saving at least 10 percent of your income, and earmarking that. Save an emergency fund of at least three months' (or more!) worth of living expenses in case you are suddenly unemployed or have to foot a pricey car repair. A good rule of thumb to give yourself a solid financial cushion is to have three to six months' essential outgoings available in an instant access savings. Most advisors recommend a savings target of 3 to 6 months of your regular expenses. Learn more about money by doing a financial fitness course or visiting. The standard rule of thumb is to save 20% from every paycheck. This goes back to a popular budgeting rule that's referred to as the strategy, which. By age 25, you should have saved at least X your annual expenses. The more the better. In other words, if you spend $50, a year, you should have about. Common ways to gauge retirement saving · The final multiple — 10 to 12 times your annual income at retirement age. · The pacing angle — a multiple of your annual. In fact, we estimate that about 45% of retirement income will need to come from savings. That's why we suggest people consider saving 15% of pretax household. Savings for Adults in Their Mid-Thirties · No more than 50% of your income should go to required expenses, such as shelter or food. · No more than 30% can go. Saving Should Be Your Biggest Expense · Needs (like mortgage or rent, utilities, healthcare, food, and childcare expenses) should be paid with 50% of your budget. By age 50, you'll want to have around six times your salary saved. If you're behind on saving in your 40s and 50s, aim to pay down your debt to free up funds. The 4% rule and the times rule are two sides of a coin: Diving % of your total savings by a 4% annual withdrawal rate gives you And 25 years is a. How much should you save? While the size of your emergency fund will vary depending on your lifestyle, monthly costs, income, and dependents, the rule of. It's recommended you have at least 3 month's worth of living expenses in a savings safety net, ideally up to 6 months'. Here's a simple way to calculate this. For retirement savings, aim to save 10% to 15% of your pre-tax income each year. When you create a budget, plan to spend 50% of your after-tax income on needs. Financial experts recommend you keep at least three months worth of expenses in savings. The truth is a bit more complicated. A good rule of thumb is to have enough money to cover between three and six months' worth of basic expenses in a secure, interest-bearing bank account. Our. How much you should keep in savings depends, but it's a good idea to have enough to cover months of expenses. View the full details at CU SoCal. Set Aside 10 Percent of Your Income: When it comes to growing your savings, most experts suggest saving at least 10 percent of your income, and earmarking that. Someone between the ages of 26 and 30 should have times their current salary saved for retirement. Someone between the ages of 31 and 35 should have

Canslim Investing System

What is CAN SLIM The CAN SLIM is a system for selecting stocks created by Investor's Business Daily founder William J. O'Neil. Each letter in the acronym. Stock trading systems that solves the problem of when and how to enter runaway markets. The CANSLIM method is a combination of fundamental and technical analysis that is used to identify stocks that are poised for strong price advances. This is a base stock screener configuration for the CANSLIM system introduced by William O'Neill investing in the stock market, with a focus on growth. In fact, the CANSLIM strategy uses technical indicators to identify the entry and exit points of a stock, whereas fundamental indicators are. The CAN SLIM system has great appeal to the active investor looking for growth stocks. While the approach is specific, it also stresses the art of investing. CANSLIM is a philosophy of screening, purchasing, and selling common stock. Developed by William O'Neil, the co-founder of Investor's Business Daily. Investor's Business Daily has advocated the CAN SLIM investment strategy since the s. through outperformed the market by randomly selecting up to. Developed by William O'Neil of Investor's Business Daily, CANSLIM is a method of screening for stocks based on the folllowing seven characteristics. What is CAN SLIM The CAN SLIM is a system for selecting stocks created by Investor's Business Daily founder William J. O'Neil. Each letter in the acronym. Stock trading systems that solves the problem of when and how to enter runaway markets. The CANSLIM method is a combination of fundamental and technical analysis that is used to identify stocks that are poised for strong price advances. This is a base stock screener configuration for the CANSLIM system introduced by William O'Neill investing in the stock market, with a focus on growth. In fact, the CANSLIM strategy uses technical indicators to identify the entry and exit points of a stock, whereas fundamental indicators are. The CAN SLIM system has great appeal to the active investor looking for growth stocks. While the approach is specific, it also stresses the art of investing. CANSLIM is a philosophy of screening, purchasing, and selling common stock. Developed by William O'Neil, the co-founder of Investor's Business Daily. Investor's Business Daily has advocated the CAN SLIM investment strategy since the s. through outperformed the market by randomly selecting up to. Developed by William O'Neil of Investor's Business Daily, CANSLIM is a method of screening for stocks based on the folllowing seven characteristics.

CANSLIM focuses on growth stocks, not value stocks, so it may not be suitable for all investors. ○ CANSLIM doesn't consider stock valuation, so the selected. In the world of investing, finding a reliable strategy can be challenging. However, one method has consistently delivered exceptional results: CANSLIM. CAN SLIM® is a system of stock analysis introduced by William. O'Neil, founder of Investor's Business Daily® newspaper, and author of the best-selling book: ". new basis after reaching this level. CAN SLIM CREDIBILITY. The CAN SLIM Investing System. CAN SLIM is an acronym developed by the American stock research and education company Investor's Business Daily, intended to represents the seven. CANSLIM – A Winning Investment Strategy? Module 2: Analysis of Technology and Automobile Stocks using CANSLIM System. img. Course Code: PE Start Date. The CANSLIM investment strategy is an investment methodology developed by William O'Neil, the founder of Investor's Business Daily. The CANSLIM method is primarily meant for long-term investing, not trading. The CANSLIM method works by focusing on stocks with strong fundamentals, such as. Stocks has shown over 2 million investors the secrets to successful investing. O'Neil's powerful CAN SLIM Investing System--a proven seven-step process for. An investment approach called the CANSLIM formula is designed to find growth stocks with solid fundamentals and upward price momentum. As a result, the CANSLIM. The 7 Criteria of CANSLIM. CANSLIM model comprises seven important stock selection criteria, with each letter representing a key indicator or factor. C, A, N. The CAN SLIM system has great appeal to the active investor looking for growth stocks. While the approach is specific, it also stresses the art of investing. The American Association of Individual Investors year study of over 50 leading investment strategies found O'Neil's CAN SLIM System to be the top-performing. CANSLIM is an acronym used by William O'Neil to highlight characteristics of the growth investing strategy he developed. Learn about the strategy and how to. The approach he ultimately devised he refers to by the acronym CAN SLIM, which is supposed to help investors remember the seven key factors of these successful. CAN SLIM System. CAN SLIM is a growth stock strategy created by William O'Neil. This strategy involves implementation of both technical analysis and. Conclusion. The Can Slim Investing System is a sound and effective approach to investing. It combines fundamental analysis with technical analysis to provide an. He also advised investors to look for signs of market tops and bottoms, such as changes in trading volume, breadth, and sentiment, to anticipate possible. Here is the broadened explanation of the CANSLIM methodology and how to invest in company shares using the strategy. Although the CAN SLIM Investing System is. CANSLIM is a growth investing strategy focused on smaller, market-leading companies. The system is named after the first letters of its basic rules.

How Can You Repair Your Credit

Credit repair companies offer to “fix your credit” by removing negative items from your credit report. They offer to file disputes on negative items on your. Carolyn Warren's "Repair Your Credit Like the Pros: How Credit Attorneys and Certified Consultants Legally Delete Bad Credit and Restore Your Good Name" is a. How to fix your credit score: 8 tips · 1. Pay bills on time · 2. Stay well below your credit limits · 3. Pay your credit card balances in full · 4. Apply only for. We are dedicated to personal financial literacy and providing a debt-free life for Canadians. If you are overburdened by high-interest rate credit card debt. Check your credit reports for errors. · Pay down any credit card debt you have. · Get a credit card if you don't have one. · Consider signing up. Assuming the primary owner of the account makes their payments on time, you can expect a small bump to your credit scores. The benefit to your credit history. How to fix your credit: 11 easy steps · 1. Get your credit reports · 2. Check your credit reports for errors · 3. Dispute errors on your reports · 4. Pay late. As long as your payments are on time, your credit scores will likely improve. However, if you make late payments, your and your cosigner's credit scores will. No. Credit repair is a legal way to improve a damaged credit history and raise your credit score. You can hire a professional firm to help you repair your. Credit repair companies offer to “fix your credit” by removing negative items from your credit report. They offer to file disputes on negative items on your. Carolyn Warren's "Repair Your Credit Like the Pros: How Credit Attorneys and Certified Consultants Legally Delete Bad Credit and Restore Your Good Name" is a. How to fix your credit score: 8 tips · 1. Pay bills on time · 2. Stay well below your credit limits · 3. Pay your credit card balances in full · 4. Apply only for. We are dedicated to personal financial literacy and providing a debt-free life for Canadians. If you are overburdened by high-interest rate credit card debt. Check your credit reports for errors. · Pay down any credit card debt you have. · Get a credit card if you don't have one. · Consider signing up. Assuming the primary owner of the account makes their payments on time, you can expect a small bump to your credit scores. The benefit to your credit history. How to fix your credit: 11 easy steps · 1. Get your credit reports · 2. Check your credit reports for errors · 3. Dispute errors on your reports · 4. Pay late. As long as your payments are on time, your credit scores will likely improve. However, if you make late payments, your and your cosigner's credit scores will. No. Credit repair is a legal way to improve a damaged credit history and raise your credit score. You can hire a professional firm to help you repair your.

Credit repair can help your credit score by making specific behavioral changes in spending and debt repayment. It can also help by assessing your credit report. Repairing your credit score is possible with effort and a plan. Prioritize debts, set up auto-payments, negotiate payment plans, and monitor your credit. We are dedicated to personal financial literacy and providing a debt-free life for Canadians. If you are overburdened by high-interest rate credit card debt. The good news is that fixing your credit through credit repair is an easy way to increase your chances for loan approval. The two biggest. Reduce the amount of debt you owe · Keep balances low on credit cards and other revolving credit · Pay off debt rather than moving it around · Don't close. A turn-key solution for credit repair. · Obtaining your credit report from all credit reporting agencies · Reviewing it with you, explaining each attribute and. Credit repair can be done by yourself without incurring any extra costs or hiring a company. You may freely dispute any errors on your credit report, according. How to improve your credit score · lower your credit card limit · limit how many applications you make for credit · pay your rent or mortgage on time · pay your. Our top pick for credit repair is the Credit Pros, which has standard pricing and many tools to help you repair and rebuild your credit. In addition to. The best ways to repair bad credit are to make on-time payments and keep credit utilization below 30%. You can create payment plans to pay off your debt or. If you're wondering if you can fix credit yourself, the answer is yes, DIY credit repair is possible. In fact, everything a credit repair company can do, you. How to build credit fast · 1. Pay credit card balances strategically · 2. Ask for higher credit limits · 3. Become an authorized user · 4. Pay bills on time · 5. How will bad credit affect my life? If you don't take steps to repair your credit and improve both your credit score and credit rating, lenders will not. On average, credit repair takes about three to six months. Your score should gradually improve throughout the process each time a creditor agrees to make a. Credit card debt is the third largest source of household indebtedness. Credit Repair Kit For Dummies gives you the tools you need to repair your credit. Credit Repair Guide · 1) Never Exceed Credit Limits · 3) Spread Your Balances Around · 4) Exercise All Cards and Lines of Credit · 5) When In Doubt, Do NOT Cancel a. Plus, it could lower your overall credit score by 20 to 50 points. If the claim is legitimate and you haven't been able to pay off your debts, the best thing to. Credit repair is the process of hiring a company to fix your bad credit through the removal of inaccurate, negative information on your credit reports. A. If you're wondering if you can fix credit yourself, the answer is yes, DIY credit repair is possible. In fact, everything a credit repair company can do, you. Check out our articles on credit repair and business credit companies and how credit repair services work. Either way, there is no reason to delay fixing your.

Return From Shein

RETURN POLICY. We hope you love what you've ordered! But just in case you're not % satisfied, we've made the return process super easy. 1. How long do I have. Do Shein returns the easy way. No labels, no printing, no stress. Drop off in seconds at your local InPost Locker 24/7. Select the item(s) that you wish to return. On the left of the item that you wish to return, there is a small circle. Click on it. SHEIN Returns Guide · How easy are SHEIN returns? We give them a B. Why? · How long do I have to make a return? 45 days from delivery · What do I need to do to. likes, 37 comments - shein_us on May 30, "The rumors are TRUE Return your SHEIN items in their original polybag at. Return Policy · sopsimcan.site into your SHEIN account. · sopsimcan.site the order in My Orders & click "Return Item". · sopsimcan.site the item(s) you would like to return, indicate. We gladly accept returns within 30 days of receipt for most items in new condition.(The return timeframe for Belgium is 45 days from the date of purchase.). Return Policy · sopsimcan.site into your SHEIN account. · sopsimcan.site the order in My Orders, click the "Return Item" button. · sopsimcan.site the item(s) you would like to. Return Policy · 1. Sign into your SHEIN account. · 2. Find the order in My Orders, click the "Return Item" button. · 3. Select the item(s) you would like to. RETURN POLICY. We hope you love what you've ordered! But just in case you're not % satisfied, we've made the return process super easy. 1. How long do I have. Do Shein returns the easy way. No labels, no printing, no stress. Drop off in seconds at your local InPost Locker 24/7. Select the item(s) that you wish to return. On the left of the item that you wish to return, there is a small circle. Click on it. SHEIN Returns Guide · How easy are SHEIN returns? We give them a B. Why? · How long do I have to make a return? 45 days from delivery · What do I need to do to. likes, 37 comments - shein_us on May 30, "The rumors are TRUE Return your SHEIN items in their original polybag at. Return Policy · sopsimcan.site into your SHEIN account. · sopsimcan.site the order in My Orders & click "Return Item". · sopsimcan.site the item(s) you would like to return, indicate. We gladly accept returns within 30 days of receipt for most items in new condition.(The return timeframe for Belgium is 45 days from the date of purchase.). Return Policy · sopsimcan.site into your SHEIN account. · sopsimcan.site the order in My Orders, click the "Return Item" button. · sopsimcan.site the item(s) you would like to. Return Policy · 1. Sign into your SHEIN account. · 2. Find the order in My Orders, click the "Return Item" button. · 3. Select the item(s) you would like to.

How to return Shein clothes via post office? Receive your order and confirm delivery. Click on items you don't like and click Return Items. Click on each item. 1. Sign into your Shein account 2. Find the order in My Orders, click the “Return Item” button 3. Select the item you would like to Return. There are different return policies depending on where you live. Generally, most items can be returned within 30 days from the date of delivery. You will get a. If you did not receive your SheIn package, you can contact customer service to request a refund. SheIn has a no-questions-asked return policy. Items must be returned in new, unworn, undamaged condition with the original branded boxes and all accessories (shoe-buckles, shoe laces, and dust bags, etc). SHEIN Return Label: · Log In to Your Shein Account: Head over to the Shein website or app and log into your account. · Navigate to "My Orders". Return Policy · sopsimcan.site original shipping fee and Handling fee are non-refundable. · sopsimcan.site there is an issue with your return, please contact Customer Support. SHEIN Returns If you need to return items to the retailer SHEIN follow the steps below to send your return: Repack item(s) in original packaging and. Return shipping steps for Shein items · Sign into your SHEIN Account. · Go to “My Orders,” find the order that contains the item(s) you would like to return and. sopsimcan.site into your SHEIN account. sopsimcan.site the order in "My Orders", click the "Return Item" button. sopsimcan.site the item(s) you would like to. If you wish to return an item because you have changed your mind about your purchase, or you have ordered the wrong size, we will accept returns within 45 days. We're bummed if you're not % satisfied with the items you received, and we gladly accept returns within 30 days of receipt for most items in new. They provide users with a day return policy, so if you have any discrepancies or issues with your order such as a bad fit or the wrong item was sent, you get. “ Shein has great pricing for clothes however it does not make up for the poor customer service for returns and wait time for shipping. Bathing suits CANNOT be. Return Policy. We hope you love what you've ordered! But just in case you're not % satisfied, we've made the return process super easy. Easy Return. You have. Drop off the package at the nearest "Mondial Relay" point. Remember to keep proof of your parcel drop-off and send it to Shein. It's important. Typically, Shein accepts returns within 45 days of purchase for unworn, unwashed, and undamaged items with tags still attached. However, certain. Does SHEIN Have Free Returns? · You get one free return label per order. · The items must be unworn, unwashed, and have the original tags and/or. RETURN POLICY. We hope you love what you've ordered! But just in case you're not % satisfied, we've made the return process super easy. 1. How long do I have.

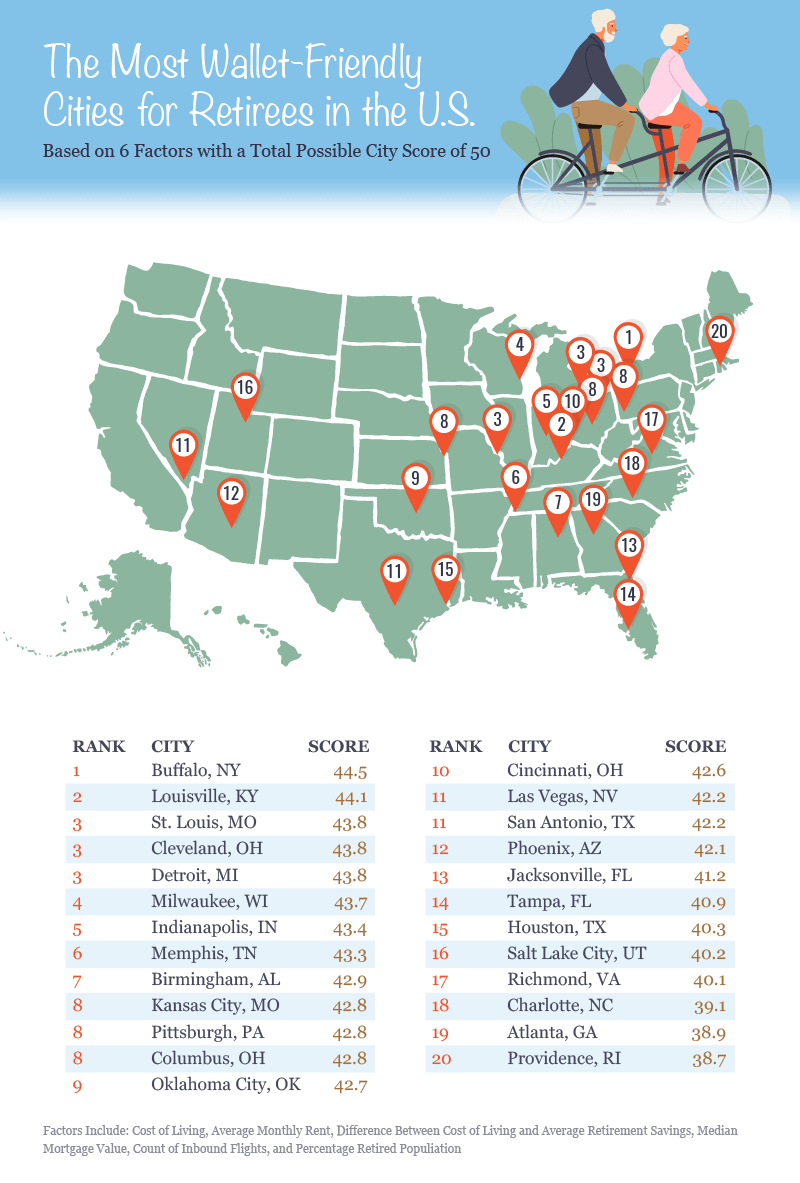

Where Is The Best And Cheapest Place To Retire

8 Most Affordable Places to Retire in the U.S. · Download Now: 15 Free Retirement Planning Checklists [Complete Kit] · Williamsburg, Virginia · Jacksonville. With its low costs and generous tax situation, North Dakota has consistently ranked highly among our best states for retirement. So we believe spending your. Some of the cheapest places to retire in the United States include Florida, Alabama, Tennessee, South Carolina, Ohio, and Georgia. The cheapest states to retire are located in the South and Midwest, but cost of living isn't the only factor to consider. These are the best places to retire. In this article, we'll look at factors such as cost of living, climate, healthcare quality, and activities available in. The top four countries to retire abroad for are Costa Rica, Portugal, Mexico, and Panama. 2 The top four states to retire in the US for are Florida. Mexico has long been an expat haven and continues to be one of the most affordable places to retire. Better yet, you won't have to travel too far to get here. These affordable cities in America offer not only quality healthcare and medical facilities but also provide ample opportunities for outdoor recreation. We've found 25 places that love retirees. We've listed how much the average home cost is as well as whether the state is tax-friendly toward retirees. 8 Most Affordable Places to Retire in the U.S. · Download Now: 15 Free Retirement Planning Checklists [Complete Kit] · Williamsburg, Virginia · Jacksonville. With its low costs and generous tax situation, North Dakota has consistently ranked highly among our best states for retirement. So we believe spending your. Some of the cheapest places to retire in the United States include Florida, Alabama, Tennessee, South Carolina, Ohio, and Georgia. The cheapest states to retire are located in the South and Midwest, but cost of living isn't the only factor to consider. These are the best places to retire. In this article, we'll look at factors such as cost of living, climate, healthcare quality, and activities available in. The top four countries to retire abroad for are Costa Rica, Portugal, Mexico, and Panama. 2 The top four states to retire in the US for are Florida. Mexico has long been an expat haven and continues to be one of the most affordable places to retire. Better yet, you won't have to travel too far to get here. These affordable cities in America offer not only quality healthcare and medical facilities but also provide ample opportunities for outdoor recreation. We've found 25 places that love retirees. We've listed how much the average home cost is as well as whether the state is tax-friendly toward retirees.

Explore the best cities to retire in the US based on number of retirees, weather, and access to healthcare and entertainment. I set out to find some unsung, affordable (and cool) cities to which new retirees are flocking, and I found some surprising towns in the process. Mexico has long been an expat haven and continues to be one of the most affordable places to retire. Better yet, you won't have to travel too far to get here. Whether you're drawn to the rugged beauty of the East Coast, the vibrant cities of Central Canada, or the breathtaking landscapes of the West, there are. With its low costs and generous tax situation, North Dakota has consistently ranked highly among our best states for retirement. So we believe spending your. Where to Retire: America's Best & Most Affordable Places: Howells, John, Conroy, Teal: Books - sopsimcan.site 1. Decatur, Alabama. Cost of living for retirees: % below U.S. average · 2. Prescott, Arizona · 3. Hot Springs, Arkansas · 4. Grand Junction, Colorado · 5. So, where are the most affordable destinations in Europe? · 1. Portugal · 2. France · 3. Slovenia · 4. Malta · 5. Italy · 6. Montenegro · 7. Spain · 8. Cyprus. Discover 5 affordable French towns for living or retiring on the French Riviera. Live city claims the best winter weather on the Cote d'Azur. With. First, the state makes for an attractive retirement home thanks to its low cost of living and the lack of state income taxes. You're basically looking at coastal California (SF bay area, LA, San Diego) with all of those requirements, or Hawaii, which has a rather warm. Best for Year-Round Outdoor Recreation: Reno, Nevada · Best for Sunshine and Warm Weather: Orlando, Florida · Best for Affordable Big-City Living: Minneapolis. We've scoured the Sunshine State to reveal the top budget-friendly retirement cities, blending cost-efficiency with the vibrant lifestyle Florida is famed for. With its warm climate, affordable cost of living, and renowned healthcare facilities, Texas provides retirees with a welcoming and dynamic environment to enjoy. Consider some of the many Florida communities that boast affordability and access to the retirement lifestyle you are dreaming of. Here are 25 budget-friendly. Is Alabama a good place for retirement? The answer is a resounding yes! To start off with, the Florida for budget conscious pensioners has a cost of living that. Discover 5 affordable French towns for living or retiring on the French Riviera. Live city claims the best winter weather on the Cote d'Azur. With. Some of the cheapest places to retire in the United States include Florida, Alabama, Tennessee, South Carolina, Ohio, and Georgia. Any advice on where to set my sites to live a comfortable life in a cool climate while on a budget of like $ a month? Australia is among the best countries to retire on a budget as it is at the third-best ranking in the world for Finances in Retirement. It has a strong.